Do Your Best From The Get-Go

GST Registration

Currently, GST Registration is required for all items and services with the exception of those involving Petroleum. The Goods and Services Tax (GST) is a consolidated tax, meaning that the State Indirect Tax and the Centre Indirect Tax have been combined. The entire nation is now subject to the same tax structure. It now substitutes service tax, excise, VAT, entertainment tax, luxury tax, octroi, CST etc.

Before, the threshold at which goods and services were no longer required to collect GST was Rs 20 million. Nevertheless, according to the most recent change, businesses with an annual revenue of up to Rs 40 lakh don’t have to pay GST. Also, businesses having a turnover of up to Rs 1.5 crore have the option of participating in the 1% tax Composition Program. Yet, 20 lakhs remain the exemption ceiling of turnover for services. Composition scheme for services allows service providers with a turnover of up to 50 lakhs to pay just 6% tax.

So, only those dealers, manufacturers, enterprises, people, professions, etc. whose turnover (sales) surpass INR 40 Lakh will be required to become GST registered. If your sales are less than INR 40 Lakh, you may also voluntarily apply for GST Registration in case you desire to reap the benefits of Input Tax Credit. It’s also mandatory for anyone conducting business beyond state lines to register for GST. These restrictions do not apply to them.

The GST registration process requires Aadhar card:

As of the 21st of August, 2020, a newly implemented system will need the use of an Aadhar card in order to register for GST. This implies that going forward, each individual applying for GST registration would have the choice of using Aadhaar authentication or undergoing a physical verification process. Assuming the applicant chooses to use Aadhaar authentication for GST registration, the registration process may be completed in about three days.

Benefits from GST Registration

Here are some of the benefits a taxpayer may expect to get from getting GST registered:

- For all intents and purposes, the Taxpayer will be considered a legitimate business that provides goods and services to consumers.

- It means he may lawfully charge sales tax to his clients and give them a refund for the taxes they already paid on the products or services they received from him.

- He may deduct the taxes he has already paid on his purchases and use that money to cover the taxes he owes for the sale of goods and services.

- Nationally seamless transfer of Input Tax Credits from providers to beneficiaries

If you require this service, you are requested to contact our compliance manager 08943620159 or by email at info@techmincsc.in.

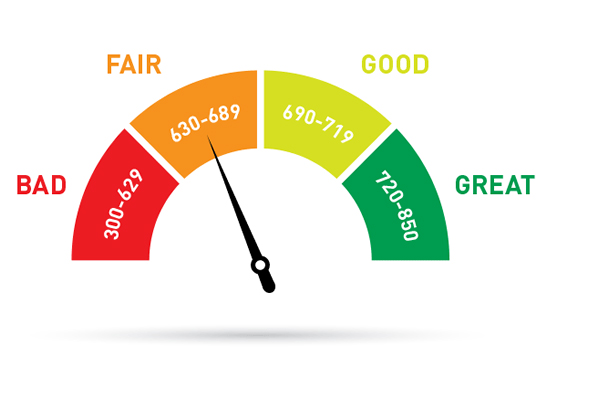

Check CIBIL Score Now

CIBIL Score is a three-digit numeric summary of your credit history. The score is derived using the credit history found in the CIBIL Report (also known as CIR i.e Credit Information Report).

A CIR is an individual’s credit payment history across loan types and credit institutions over a period of time

Copyright © 2024 TECHMIN CONSULTING | Powered by TECHMIN CONSULTING