Do Your Best From The Get-Go

TAN Card

A TAN, or Tax Deduction and Collection Account Number, is a ten-digit string of letters and numbers used for tax purposes. Everyone who is liable for withholding or collecting the tax must receive the number.

The Income Tax (IT) Department assigns the number in accordance with Section 203A of the Income Tax Act, 1961. All TDS returns must include it as a necessary field.

Why Do We Need TAN?

All persons need a TAN since TIN facilitation centres will not accept Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) returns without one. If a TAN is not included, a challan for paying TDS or TCS would be rejected by the bank.

It is important to note that there is a penalty of Rs.10,000 for not applying for a TAN or for failing to quote the 10-digit alphanumeric number in certain documents, such as TDS/TCS returns, e-TDS/e-TCS returns, TDS/TCS certificates, and TDS/TCS payment challans.

Who Require a TAN?

The 10-character alphanumeric TAN is required by anybody who must deduct or collect tax at the source on behalf of the Income Tax department.

Categories of TAN

One may categorise TAN applications into two broad categories. These items are:

- New TAN Request Form

- Change/Correction of TAN Data Form for Previously Issued TAN

If you require this service, you are requested to contact our compliance manager 08943620159 or by email at info@techmincsc.in.

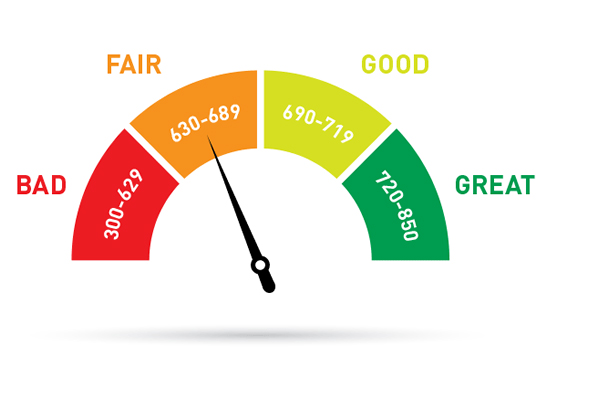

Check CIBIL Score Now

CIBIL Score is a three-digit numeric summary of your credit history. The score is derived using the credit history found in the CIBIL Report (also known as CIR i.e Credit Information Report).

A CIR is an individual’s credit payment history across loan types and credit institutions over a period of time

Copyright © 2024 TECHMIN CONSULTING | Powered by TECHMIN CONSULTING