Do Your Best From The Get-Go

Income Tax Returns

Taxpayers are required to report all of their taxable income, any deductions that are allowed, and any tax payments that have been made on their behalf on a tax return. The process is referred to as “ITR Filing” in the tax world.

You are eligible for an Income tax refund if you have overpaid your taxes. If it’s the other way around, you need to make up any outstanding payments before submitting your income tax return. The terms Tax Deducted at Source (TDS) and Advance Tax are used to describe situations in which extra taxes have been paid in advance. If this is the case, your tax returns must accurately reflect your income and tax payments.

Depending on your income bracket or business structure, you’ll need to file either ITR 1 or ITR 7. There are different disclosure needs for distinct formats.

In India, ITR forms must be submitted digitally; no paper forms are accepted. You may file your taxes online and save going to the tax office in person. To the extent possible, all required paperwork should be uploaded digitally. Regardless of the Accounting Year you choose, you must submit an income tax return for the Fiscal Year (i.e., April 1 through March 31).

When it comes to providing incorporation, compliance, advising, and management consultancy services to customers in India Techmin Consulting is a cutting-edge business platform and innovative idea. With Techmin Consulting, submitting your income tax returns online is simple, quick, affordable, and effortless. Moreover, Techmin Consulting facilitates the filing of GST Returns, TDS Returns, PF Returns, and ESI Returns in addition to Income Tax Returns. We provide free consultations with our compliance manager, who can be reached at 08943620159 or info@techmincsc.in.

Why You Should File Income Tax Returns? (it should be in boxes)

Reported Earnings

It is mandatory to file your ITR in India if you have any taxable income there. If an individual’s taxable income is more than INR 2.50 Lakh, then this applies to them. Companies, Limited Liability Partnerships, and Partnerships are required to submit an Income Tax Return (ITR) every year, regardless of whether they made a profit or a loss.

Credibility

Banks will have more faith in you and your ability to obtain credit if you file your tax returns on time. It is nonetheless recommended that you file an ITR even if you are not legally required to do so. A copy of your ITR can be used as evidence that you earned money. There isn’t any other written material that serves this purpose.

Loss Carryover

You need to file your return if you want to be able to deduct company losses from previous years’ taxes. Only until you have taxable income can you take advantage of this. This means that such losses can be deducted from taxable income.

Statistically Significant Strength in the Area of Finances

Having a history of timely and accurate ITR filings is a sign of fiscal stability and reliability. In doing so, you’ll be able to get a visa and a speedy bank loan. As a result, routine ITR submissions are strongly encouraged.

Paid-Back Taxes

Every time your tax withholding (TDS) is more than your actual tax liability, you can request a refund by completing a timely and accurate income tax return. If you fail to submit an ITR, you will not get any reimbursements.

Keeping Tax Audits at Bay

If you haven’t submitted your ITR by a certain date, you may be in violation of the law if you meet any of the various requirements outlined in the Act. By timely and accurately filing your ITR, you can avoid any of these penalties.

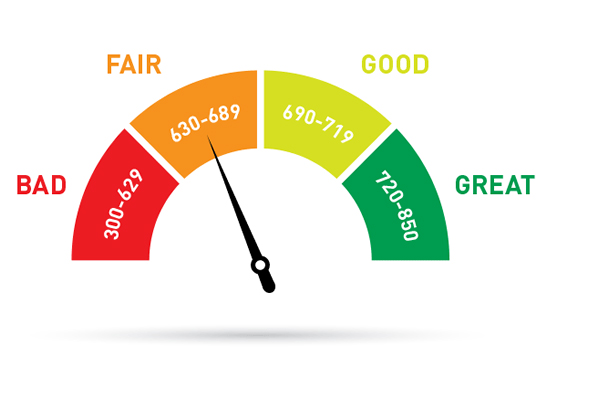

Check CIBIL Score Now

CIBIL Score is a three-digit numeric summary of your credit history. The score is derived using the credit history found in the CIBIL Report (also known as CIR i.e Credit Information Report).

A CIR is an individual’s credit payment history across loan types and credit institutions over a period of time

Copyright © 2024 TECHMIN CONSULTING | Powered by TECHMIN CONSULTING