Do Your Best From The Get-Go

Reply to Income Tax Notices

Tax notifications are very common, but the ways in which you might respond to them are not. These letters are sent by the Income Tax Department for a number of reasons, including but not limited to, failure to file income tax returns, mistakes in filing returns, and the need for further information or documents. With our team’s assistance, you may submit your taxes in accordance with the notice and avoid any legal complications.

How often advance notice could I expect?

- Notification notice

- Enquiry notice

- Defective Return notice

- Scruitiny Notice

- Demand Notice

- Use this year’s refund to offset any back taxes from prior years.

- Correctly paying a lower tax rate or not disclosing income

We provide free consultations with our compliance manager, who can be reached at 08943620159 or info@techmincsc.in.

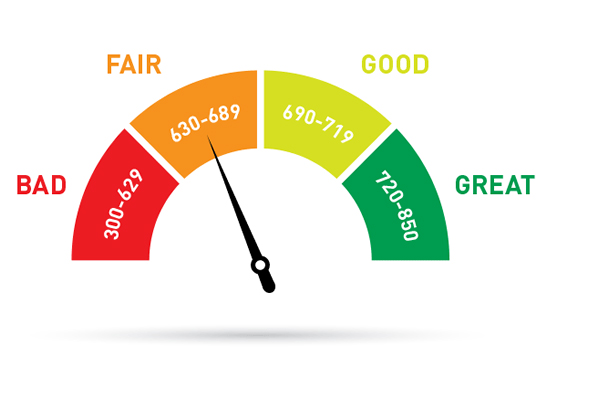

Check CIBIL Score Now

CIBIL Score is a three-digit numeric summary of your credit history. The score is derived using the credit history found in the CIBIL Report (also known as CIR i.e Credit Information Report).

A CIR is an individual’s credit payment history across loan types and credit institutions over a period of time

Copyright © 2024 TECHMIN CONSULTING | Powered by TECHMIN CONSULTING