Do Your Best From The Get-Go

Sole Proprietor

What does it mean to be a “sole proprietor”?

When referring to a business, the term “sole proprietorship” refers to a company that is wholly owned, operated, and managed by a single individual. Single Proprietor of the Company refers to the person who owns the Business. Since the business is being managed by a real person, there is no separate entity in the eyes of the law between the promoter and the business. All of the money made goes to the promoter. There is no need to file paperwork to start a sole proprietorship.

While there are less requirements for formality and lower fees to create a sole proprietorship, it is rather simple to get one up and running.

There is no registration system for single proprietorship firms in India, and the government has not issued any laws or regulations governing them.

However, a sole proprietorship may only be legally recognised as such through the acquisition of the appropriate tax registrations.

In order to prove that the Proprietor is running a business in his or her own name, he or she must get the appropriate tax registrations, such as GST Registration and/or SSI/MSME / Udyam Aadhar Registration.

Compliance required by Proprietorship firm

- GST Registration

- GST Return

- MSME registration

- Accounting

- IT Return

- Tax Audit

Characteristics of a Sole Proprietorship Business

- Easy Decision Making

- Easy To Start

- Easy to close

- Tax benefits

- Self employment

- Inexpensive

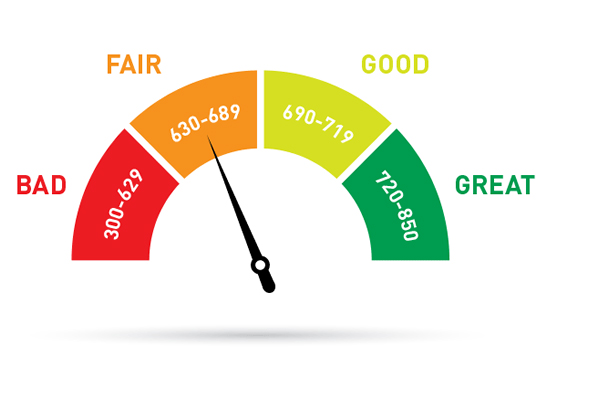

Check CIBIL Score Now

CIBIL Score is a three-digit numeric summary of your credit history. The score is derived using the credit history found in the CIBIL Report (also known as CIR i.e Credit Information Report).

A CIR is an individual’s credit payment history across loan types and credit institutions over a period of time

Copyright © 2024 TECHMIN CONSULTING | Powered by TECHMIN CONSULTING