Do Your Best From The Get-Go

TDS Returns

Tax Deducted at Source is what this acronym means. Each organisation or individual that makes a payment in excess of the threshold amounts specified in the Income Tax Act is obligated to withhold tax at the point of payment. In order to comply with tax regulations, TDS must be withheld at the rates set forth by the tax department, and a TDS Return must be filed using the correct TDS Return Forms.

- Those who are responsible for making withholding tax deductions must submit a TDS Return.

- The Income Tax Department of India requires that you file this form every three months.

- Filing TDS Return is necessary if you are a deductor.

- Provide any information pertaining to the TDS that you deducted and deposited during that quarter.

Pre-requisites of TDS Return Filing

- Obtaining a valid Tax Deduction Account Number (TAN) and Permanent Account Number (PAN) is the first step in submitting a TDS Return. It is your responsibility to determine whether payments warrant tax withholding.

- Specifics of a Purchase or Payment Will Be Provided.

- Liable payments often include things like wages, interest, professional fees, payments to contractors, payments for the use of equipment and buildings, and so on.

- According to the Income Tax Act of 1961, there are standard rates for all TDS payments.

Types TDS return forms:

- Statement of Tax Deducted at Source from Wages and Salaries (Form 24Q)

- Form 26Q is the TDS form for reporting tax withheld from sources other than wages.

- Statement for Tax Deduction on Income Received from Interest, Dividends, or Other Sums Payable to Non Residents (Form 27Q).

- Form 27EQ, Statement of Tax Collected at Source, is used to report any tax withholdings that have been made.

You must submit Form 24Q (TDS on salary payments) and Form 26Q (TDS on payments other than salaries) every three months if you are a deductor who has made payments to resident Indians related to any of the aforementioned. Form 27Q must be filed on a quarterly basis if you have made any payments to non-residents.

Correctly filing your TDS Returns is required in order to create Form 16A and Form 16 (TDS Certificates).

When it comes to providing incorporation, compliance, advising, and management consultancy services to customers in India Techmin Consulting is a cutting-edge business platform and innovative idea. With Techmin Consulting, submitting your income tax returns online is simple, quick, affordable, and effortless. Moreover, Techmin Consulting facilitates the filing of GST Returns, TDS Returns, PF Returns, and ESI Returns in addition to Income Tax Returns. We provide free consultations with our compliance manager, who can be reached at 08943620159 or info@techmincsc.in.

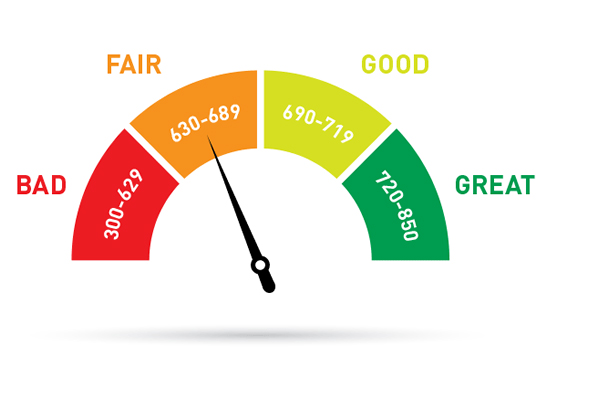

Check CIBIL Score Now

CIBIL Score is a three-digit numeric summary of your credit history. The score is derived using the credit history found in the CIBIL Report (also known as CIR i.e Credit Information Report).

A CIR is an individual’s credit payment history across loan types and credit institutions over a period of time

Copyright © 2024 TECHMIN CONSULTING | Powered by TECHMIN CONSULTING