A personal loan is a loan that does not require collateral or security and is offered with minimal documentation. You can use the funds from this loan for any legitimate financial need. Like any other loan, you must repay it according to the agreed terms with the bank. Normally this can include a few months to a few years in easily equated monthly installments.

What is a personal loan used for?

You are free to use the funds you get from a personal loan any way you wish – fund a holiday, buy a gadget, pay for medical treatment, use on home renovation, spend on a wedding, finance your children’s education, etc.

How do personal loans work?

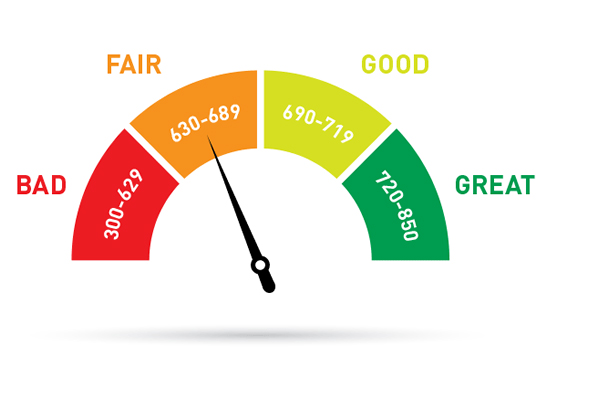

A personal loan works pretty much the same way as most loans. You apply for a loan, submit the documents, the bank checks your creditworthiness, and makes a loan offer. If you accept it, the funds are transferred to your bank account, and you can use them any way you like.

You must repay the loan in equated monthly installments (EMI), which will depend on factors such as loan amount, tenure, and interest rate.

What about interest rates, tenure, etc?

Interest rates on personal loans: Interest rates can range will depend on your credit history, tenure, income, occupation, etc. The rates are fixed and not floating rate.

Tenure and repayment: You can get a loan for a tenure that suits your needs. You must repay the loan in equated monthly installments or EMIs in a fixed sum every month. The EMI will depend on the loan amount, tenure, and interest rate. You can check your eligibility here.

Applications can be submitted for personal loans from the following banks.

Apply Now